Canadian Capitalism's Hot Mess of Climate Contradictions (Part One)

Part one: The political economy of Canadian fossil-capitalism and why it’s so dangeous to the planet

Photo by Robin Sommer on Unsplash

Photo by Robin Sommer on Unsplash

Have you ever wondered why Canada exists as such a tangle of climate contradictions? We’re talking about a nation that is consistently a top 10 greenhouse gas emitter in the world, despite having under 0.5% of the global population. One that has literally never met a greenhouse gas emissions reduction target, even though all of those targets were woefully inadequate to begin with. A country that passed a law declaring a climate national emergency, yet has no mainstream political party or leader able to offer an adequate climate plan. Canada faces extreme risks due to warming at twice the rate of the world average, yet is expected to add 25% of the world’s new crude oil production through to 2050. What can possibly explain this state of affairs? And what do those insights tell us about how to solve the problem?

This is the first in a series of posts on Canadian capitalism’s climate contradictions and Canada’s massively oversized role in driving the climate crisis. In this initial analysis, I examine the role of the fossil fuel industry in Canadian capitalism, which is paradoxically a sector that is moderately sized and declining as a share of the economy, yet also dominant in other regards. Fossil capital exercises considerable economic and political clout in Canada because it has been an extremely important site for new investment, commands huge amounts of capital, and produces the nation’s most important trade goods.

The political economy of Canadian fossil capitalism

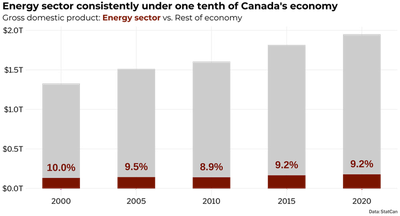

Canada has the third largest proven oil reserves in the world and is a top producer and exporter of fossil fuels. As such, one might expect the sector to account for a very large share of the Canadian economy. In terms of the economic value of output, the energy industry is significant, but far from dominant, accounting for 9 to 10% of Canada’s gross domestic product from 2000 onward. In 2020, the value of energy sector production was about $180B, just a few billion less than the manufacturing sector. An important industry, accounting for about a tenth of the economy, but certainly not enough to explain it’s outsized political and economic power. The long-term trend is a slow, gradual decline of the energy sector as a portion of Canada’s economy, despite over a decade of increasing production.

The long reach of fossil fuels in politics seems impossible to evade within the confines of Canadian settler-capitalism. Moving on from the outright denialism of the Harper era, the ruling Trudeau Liberals have at the very least recognized both the obvious urgency of the climate crisis and rising popular demands for climate action, especially among young people as they watch their future being burned for profit. In an ultimate display of cynicism, the governing Liberals talk about the need for “bold action” on the climate crisis in one breath and plan for decades of expansion of fossil fuel production and allot tens of billions in public funds for pipeline construction in the next. On the other hand, Canadian social democrats, especially those in power at the provincial level, and even the so-called Green party, have a relationship to fossil fuels that is fraught to say the least.

Fossil fuel industry vital to Canadian capitalism’s need for investment

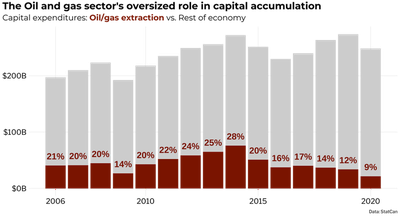

Fossil fuel and energy production industries have very high levels of capital intensity. It takes hugely expensive, long-term investments to extract, refine, and transport fossil fuels. Oil sands in particular, which account for the vast majority of Canadian oil reserves, are notoriously expensive to produce compared to other sources of oil. Thus the energy sector’s importance as a fix for investment in the Canadian economy has been greatly inflated relative to it’s share of production, with energy assets in Canada valued at over $452B in 2018.

Oil and gas extraction alone (not the energy sector as a whole), with production valued at around 4% to 5% of GDP, accounted for over a fifth of all capital investment during the early 21st Century oil boom years. Due to the capital intensity inherent in fossil fuel production, the sector has become a major nexus of capital accumulation in Canadian capitalism, conferring the considerable economic and political power of big capital. Fed by the huge flow of capital into the industry, a powerful network of fossil-capitalists has developed, situated primarily in Alberta, that link up via ownership and interlocking directories with Canada’s major financial institutions and corporate players, as well as with international capitalists, especially US based banks.

The fossil fuel capitalists and their allies in related industries have coalesced into what sociologist William K. Carroll refers to as a “regime of obstruction” aimed at protecting the centrality of fossil capital in the Canadian economy. Fossil capital has invested considerably in a nation-wide network of industry-aligned advocacy groups, think tanks, and research institutes, as well as pro-oil astro-turf groups in civil society. Even worse, fossil fuels are one of the most active and effective industries at influencing government through political lobbying, with consistent, intensive influence operations targeted at a small number of high level elected officials and unelected bureaucrats.

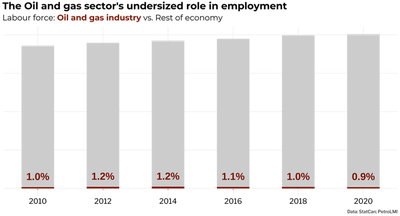

Importance of fossil fuels employment is greatly overstated

Politicians in Canada usually resort to ‘jobs, jobs, jobs’ rhetoric in order to justify their ill-conceived fossil fuel mega-projects. Such appeals are also the bread and butter of industry lobbyist and advocacy groups. Since the oil and gas industry are extremely capital intensive, jobs in the sector tend to be high-wage, but relatively few in number relative to the giant amounts of capital invested. Direct employment in oil and gas therefore accounts for only a very small portion of total employment, at around 1% of the labour force.

Since the end of the oil boom, employment in fossil fuels has been slowly declining. The oil and gas labour force peaked at over 230 thousand workers in 2014, down to 186 thousand by 2020, fewer jobs in the industry than in 2010. Given that improvements in labour productivity in oil and gas have been greatly outpacing most other Canadian industries, significant expansion of employment in the sector is unlikely to occur even with further development of oil and gas resources.

Taking into account those who are employed indirectly by the fossil fuels industry in other sectors (a figure often inflated by industry lobbyists for political purposes) the employment impact is somewhat higher, but still overall a small portion of overall employment. Certainly, it is a share of national employment so small that a managed phase out of fossil fuel employment could be accomplished mostly through voluntary attrition and retirement.

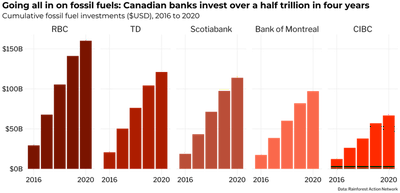

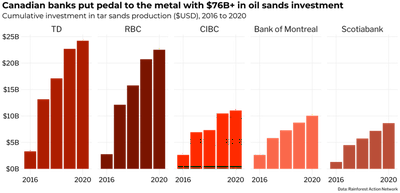

Canadian banks throw fuel on the fire, seeking to profit from the climate crisis

Canadian finance capital grew up financing colonial resource extraction from the very start. Consequently, Canadian banks have specialized in financing resource extraction both domestically and around the world. The Toronto Stock Exchange has grown into one of the most important exchanges for raising fossil fuel, energy, and pipeline capital, hosting over 20% of publicly listed oil and gas companies globally. In a recent analysis by Deloitte, Canadian corporations were ranked the third most aggressive in the world at expanding fossil fuel investment, behind only Australia and Brazil. Despite significant greenwashing efforts, Canada’s large chartered banks are all massively invested in financing the fossil fuel industry, with over $558B in new investment globally in just four years from 2016 to 2020.

The Alberta tar sands are one of the largest single fossil fuel deposits on the planet, accounting for 166 out of 171 (97%) billion barrels of Canada’s oil reserves. Oil sands accounted for 69% of Canadian oil production in 2019 and are expected, along with liquid natural gas, to represent the vast majority of fossil fuel expansion through to 2050. Canadian tar sands oil production has an incredible appetite for capital, soaking up an estimated $331B in capital investment through to 2020.

Canada’s big banks have eagerly played their part in feeding this hungry beast, though from 2016 to 2020 they accounted for only about 22% of total tar sands investment. No doubt, those financing tar sands production are aware that two decades of massive up-front capital investment into major tar sands firms are finally translating into reduced unit production costs and much higher rates of profit, making those operations substantially resilient to declining oil prices in the future.

Canada’s role in the world capitalist system: resource and energy extraction

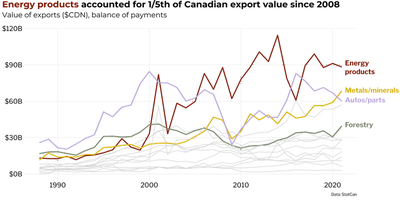

One of Canada’s main roles in capitalism’s global division of labour among imperialist states is as a producer and exporter of energy— more specifically, funneling massive amounts of energy southward, to the heart of global capitalism in the USA, where 98% of our crude oil exports go. Even though fossil fuels are declining as a share of the Canadian economy, energy products have been Canada’s most important export since the oil boom began in the early 21st Century.

From 2008 onward, energy products rose to prominence as the most important trade good, compensating for the decline of both our previously most valued goods, automobiles and parts, as well as many manufacturing sectors in general. Energy products were worth an average of 21% of the value of Canadian exports from 2008 to 2020. Energy exports are a gale force wind howling into the sails of the fossil fuel industry. According to NRCAN 3.8 out of 4.7 (80%) million barrels of oil production per day were for export in 2019. Domestic demand for fossil fuels is projected to decline through to 2050, so exports will account for the vast majority of expanded production going forward.

The dominance of energy goods in trade and importance of fossil fuels to capital accumulation in Canada, taken together, certainly explain much of the political consensus around the centrality of fossil fuels and Canada’s economic strategy for the 21st Century. No mainstream political party or leader can possibly offer (without breaking with capitalism, colonialism and imperialism) an alternative vision of Canada’s role in the world economy beyond that of the colonial resource grabber, one of the main providers of raw materials and energy for global capitalist production. There is even less room to maneuver because most of Canada’s other top exports, it must be noted, are from other greenhouse gas intensive industries such as mining and forestry and the same can be said for the investment profile of Canadian owned corporations abroad.

Canadian fossil-capital’s plan to cash in on the climate crisis

Far from contemplating an alternative economic strategy for Canada, the nation’s economic and political elites have opted to double down on the fossil fuel trade. Canadian fossil capitalists intend to compensate for the gradual decline of demand for their product domestically by exporting as much of it as possible while the industry is still viable. It is a massive gamble that they will be able to take advantage of an almost inevitable drop in oil prices, filling as much demand as possible for cheap oil to still willing customers, our Southern neighbour first and foremost. That is why the Canadian state, while paying lip service to “climate action”, was happy to fork over $23B in public funds to support oil and gas pipelines from 2018 to 2021.

The emissions reductions target set by Canada (30% less than 2005 level emissions by 2030), and most other nations, at the 2015 Paris were panned by climate scientists and even the UN Climate Change Secretariat as severely deficient. At any rate, like every other climate target Canadian governments have set, we were not really on track to meet it. In late 2020, the Liberal government released, under great pressure, a “strengthened climate plan,” that includes the most current projections of fossil fuel sector production and emissions from 2020 to 2030.

Canada’s fair share of the global carbon budget goes up in smoke

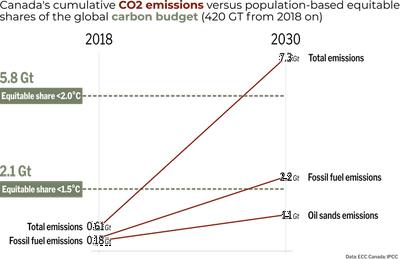

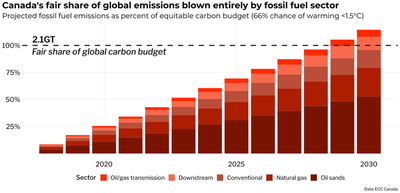

The Liberal climate plan involves intense expansion of fossil fuel production, almost entirely for export, seeing crude oil production nearly triple from 2.6 to 6.2 million barrels per day by 2030. Under the supposedly upgraded late 2020 climate plan, Canada’s total cumulative emissions will certainly exceed an equitable share of the global carbon budget with the best chance of preventing both 1.5°C and 2.0°C of warming.

Conventional emissions reduction targets are measured as a percentage of current or past emissions, which is a problem, because the rich, industrialized nations representing roughly 20% of world population are responsible for the vast majority of historical and current emissions.

An equitable alternative is a population-based carbon accounting system, where nations use up remaining emissions at a level proportionate to their share of the world population. In Canada’s case, that’s just under 0.5% of the global population, so an equitable emissions allotment should close to 0.5% of the world’s remaining limit. According to climate scientist Simon Donner, a population-based budget system is necessary, because if the minority of wealthy nations soak up a disproportionate share of the world emissions budget, there is little chance of the world avoiding even a catastrophic 3°C of warming.

In April of 2021, Justin Trudeau announced somewhat more ambitious emissions reduction targets, aiming to reduce emissions from 40% to 45% percent of 2005 emissions, for an upper bound of 465MT of annual CO₂ emissions. Despite Trudeau’s insistence that the new targets represent “bold climate action”, an analysis by the Climate Action Tracker project found that even this enhanced target was likely inadequate, especially given Canada’s abysmal record for meeting emissions targets.

According to the most recent detailed emissions projections released by the government, planned expansion of fossil fuels alone will blow Canada’s entire fair share based on population (about 2.1 billion tonnes of CO₂) of a global carbon budget with the best chance of avoiding 1.5°C of warming (about 420 billion tonnes of CO₂ from 2018 onward) Total projected emissions tops out at 114% an equitable carbon budget for Canada, with tar sands production alone torching over half of it.

Next up in the series

Most of this oil production is for export, the vast majority of which goes South to feed the energy needs of US capitalism. Trudeau himself acknowledged the extra “challenge”, to put it extremely generously, of following through on decarbonization as a top energy and fossil fuel exporter. The next post in this series will do a deep dive into Canada’s longer-term energy export strategy and its impact on the climate crisis, including existing projections for emissions and energy production up to 2050.

Data sources

- Donner, S. & Zickfield, K. 2016. “Canada’s contribution to the temperature limits in the Paris Climate Agreement."

- ECC Canada. 2021. “Canada’s Greenhouse Gas and Air Pollutant Emissions Projections 2020.” Environment and Climate Change Canada; Ottawa, ON.

- EPA. 2021. “Emission Factors for Greenhouse Gas Inventories.” Environmental Protection Agency; Washington, DC.

- IPCC. 2018. “Global Warming of 1.5°C: An IPCC Special Report on the impacts of …” Intergovernmental Panel on Climate Change.

- PetroLMI. Accessed July 2021. Employment + Labour Data. Petroleum Labour Market Information. Energy Safety Canada; Calgary, AB.

- RAN. 2021. “Banking on Climate Chaos: Fossil Fuel Finance Report 2021.” Rainforest Action Network.

- Richie, H. & Roser, M. Accessed 2020. “CO2 Emissions”. Our World In Data.

- StatCan. Accessed July 2021. Table 34-10-0035-01. “Capital and repair expenditures, non-residential tangible assets, by industry and geography."

- StatCan. Accessed July 2021. Table 36-10-0449-01. “Gross domestic product (GDP) at basic prices, by industry, quarterly average."

- StatCan. Accessed July 2021. Table 12-10-0120-01. “Historical (real-time) releases of merchandise imports and exports, customs and balance of payments basis for all countries, by seasonal adjustment and North American Product Classification System (NAPCS)."

- StatCan. Accessed July 2021. Table 14-10-0023-01. “Labour force characteristics by industry, annual."